Harold Hamm and Continental Resources donate $50 million to create transformational center focused on securing America’s energy future

The Harold Hamm Foundation and Continental Resources announced a combined $50 million gift creating the Hamm Institute for American Energy.

The Hamm Institute’s mission is to educate the next generation of energy leaders — in Oklahoma, the United States and from around the world — cementing Oklahoma’s legacy as a global energy leader.

“The generous gifts from Harold Hamm and Continental Resources to establish the Hamm Institute for American Energy will have a transformative impact on OSU and the energy sector worldwide. With a state-of-the art lab featuring wells drilled below the building, an auditorium, and classrooms, this building is fit for purpose,” OSU President Kayse Shrum said. “Mr. Hamm’s and Continental’s generosity will bring together the brightest minds and future energy sector leaders from around the world, all with a goal of solving one of society’s most pressing concerns. Together, we will change the trajectory of energy security in the United States.”

The initial funding for the institute and project will be a gift of $50 million dollars — $25 million from the Harold Hamm Foundation and $25 million from Continental Resources. The Hamm Institute will be located in what was formerly known as OSU Discovery, 300 NE 9th St. in the Oklahoma City Innovation District and will become the primary and permanent occupant of the building.

The Hamm Institute will become the center of all things American energy. It will host symposiums, authors, speakers, energy summits and global energy leadership conversations. The building will eventually house the Oklahoma Hall of Energy Legends Interactive Museum, a public exhibit highlighting the history and storied legacy of Oklahoma’s great energy leaders.

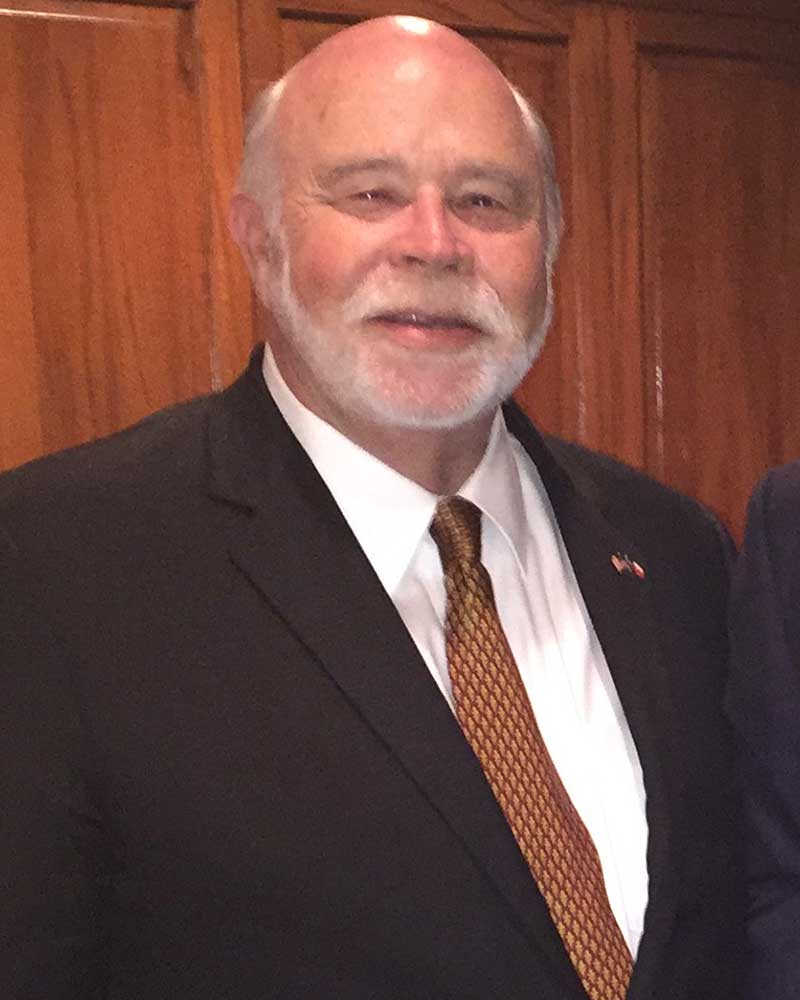

Hamm, a native Oklahoman and founder and chairman of Continental Resources, began his career in oil and gas over five decades ago, starting out with a single oil service truck and a dream. His incredible journey, entrepreneurial spirit and will to change the world for the better have inspired countless others, and his latest philanthropic push aims to elevate the state to both new and familiar heights.

Hamm is recognized as a national leader and staunch advocate of America’s domestic oil and natural gas industry. He has spent over five and a half decades in the industry, from starting his own oil services business to founding one of America’s most dynamic and innovative exploration and production companies, Continental Resources. His efforts have contributed to the well-being of every American and is helping secure the nation’s energy and economic security. The Hamm Institute will ensure America leads the world when it comes to advancing innovation and technology while responsibly producing the energy we need for decades to come.

“It’s time, once again, for Oklahoma to become a global energy leader. It’s my hope the world will look to us for the best ideas when it comes to energy stewardship, research, and education. This gift is about investing in our shared future — the future of our country and the state and people I love,” Hamm said. “ I see the Institute as a game changer — a place where the best and the brightest will come together to responsibly solve the world’s energy challenges. A third of the world lives in energy poverty. We need to fix that. And we need to make sure Americans will always have an abundance of reliable, affordable energy for generations to come.”

“Oklahoma is an energy state and Harold is our energy icon. This collaboration between one of our great universities and one of our most innovative and successful energy companies and entrepreneurs will raise the bar for American energy innovation,” said Oklahoma Gov. Kevin Stitt.

In acknowledgement of Continental’s contributions, the building’s concourse and auditorium will be named as the Continental Resources Concourse and Continental Resources Auditorium. The program fund supporting the institute also will be named in recognition of Continental.

“The Hamm Institute belongs here in Oklahoma. It is part of the Continental mission – to find, nurture and inspire the next generation of energy leaders. We envision the Hamm Institute for American Energy to be the epicenter of learning, research and energy innovation for decades to come,” said Bill Berry, Continental Resources CEO.

PHOTOS/VIDEO: A multimedia package including b-roll, soundbites and photos is available for media use here: okla.st/hamm.

MEDIA CONTACT: Mack Burke | Editorial Coordinator | 405.744.5540 | news@okstate.edu